Investing in carbon credits has become a popular way to support environmental sustainability while seeking financial returns. However, with the growing number of carbon offset projects, it can be challenging to identify which credits are trustworthy and genuinely contribute to long-term climate goals. This article explores key factors to consider when selecting carbon credits, such as project transparency, third-party verification, additionality, and permanence. By understanding these criteria, investors can make informed decisions, ensuring their contributions support credible, impactful initiatives that align with global efforts to combat climate change and promote a sustainable future.

- Which Carbon Credits Should I Trust - as I Am Looking to Invest in a Long-Term Genuine Project

- What are credible carbon credits?

- Is buying carbon credits a good investment?

- What are good carbon credits?

- What is the difference between gold standard and verra?

- Frequently Asked Questions (FAQ)

- What criteria should I consider when choosing trustworthy carbon credits for long-term investment?

- How can I verify the authenticity of a carbon credit project?

- What types of carbon credit projects are most reliable for long-term investment?

- How do I ensure that my investment in carbon credits aligns with my sustainability goals?

Which Carbon Credits Should I Trust - as I Am Looking to Invest in a Long-Term Genuine Project

Investing in carbon credits is a significant decision, especially when aiming for long-term, genuine projects that contribute to environmental sustainability. With the growing demand for carbon offsetting, it's crucial to identify trustworthy carbon credits that align with your investment goals. Below, we explore key factors to consider when selecting reliable carbon credits.

1. Understanding Carbon Credit Certification Standards

When investing in carbon credits, it's essential to ensure they are certified by reputable standards. These certifications guarantee that the projects meet rigorous environmental and social criteria. Some of the most recognized standards include:

See Also Verra Biogas Powerplant Project- Can It Register for Carbon Credits if It Already Commissioned 2 Months Ago?

Verra Biogas Powerplant Project- Can It Register for Carbon Credits if It Already Commissioned 2 Months Ago?- Verified Carbon Standard (VCS)

- Gold Standard

- Climate, Community & Biodiversity Standards (CCB)

These certifications ensure that the carbon credits are genuine, measurable, and verifiable, providing confidence in your investment.

2. Evaluating Project Types and Their Impact

Not all carbon credit projects are created equal. Some focus on renewable energy, while others emphasize reforestation or energy efficiency. To make an informed decision, consider the following:

See Also Solaxy Group Transforms Cooking in Rural Kenya With Clean Cookstove Initiative

Solaxy Group Transforms Cooking in Rural Kenya With Clean Cookstove Initiative- Renewable Energy Projects: These reduce reliance on fossil fuels and promote clean energy.

- Reforestation Projects: These capture carbon dioxide and restore ecosystems.

- Energy Efficiency Projects: These reduce overall energy consumption and emissions.

Choose projects that align with your values and have a measurable impact on reducing carbon emissions.

3. Assessing Additionality and Permanence

Additionality refers to whether the project would have happened without the carbon credit funding. Permanence ensures that the carbon reduction is long-term and not easily reversed. When evaluating carbon credits, ask:

See Also Does Anyone Know Where I Can Find Examples of Stakeholder Consultations? I'm Setting Up a Project and Would Like to See Some Example Sessions to Understand How Those Were Done

Does Anyone Know Where I Can Find Examples of Stakeholder Consultations? I'm Setting Up a Project and Would Like to See Some Example Sessions to Understand How Those Were Done- Does the project demonstrate additionality?

- Are the carbon reductions permanent?

These factors are critical to ensuring your investment contributes to real and lasting change.

4. Transparency and Third-Party Verification

Transparency is key to building trust in carbon credits. Look for projects that provide detailed documentation and undergo third-party verification. This ensures that the carbon credits are accurately measured and reported. Key aspects to consider include:

- Publicly available project reports

- Independent audits

- Clear tracking of carbon credits

These practices help prevent greenwashing and ensure the integrity of your investment.

5. Long-Term Viability and Co-Benefits

Investing in carbon credits is not just about reducing emissions; it's also about supporting projects that offer co-benefits such as:

- Biodiversity conservation

- Community development

- Improved air and water quality

Additionally, consider the long-term viability of the project. Will it continue to operate and deliver results over time? Projects with strong governance and community support are more likely to succeed in the long run.

| Factor | Description |

|---|---|

| Certification | Ensure credits are certified by reputable standards like VCS or Gold Standard. |

| Project Type | Choose projects that align with your values, such as renewable energy or reforestation. |

| Additionality | Verify that the project would not have happened without carbon credit funding. |

| Transparency | Look for detailed documentation and third-party verification. |

| Co-Benefits | Support projects that offer additional environmental and social benefits. |

What are credible carbon credits?

What Are Credible Carbon Credits?

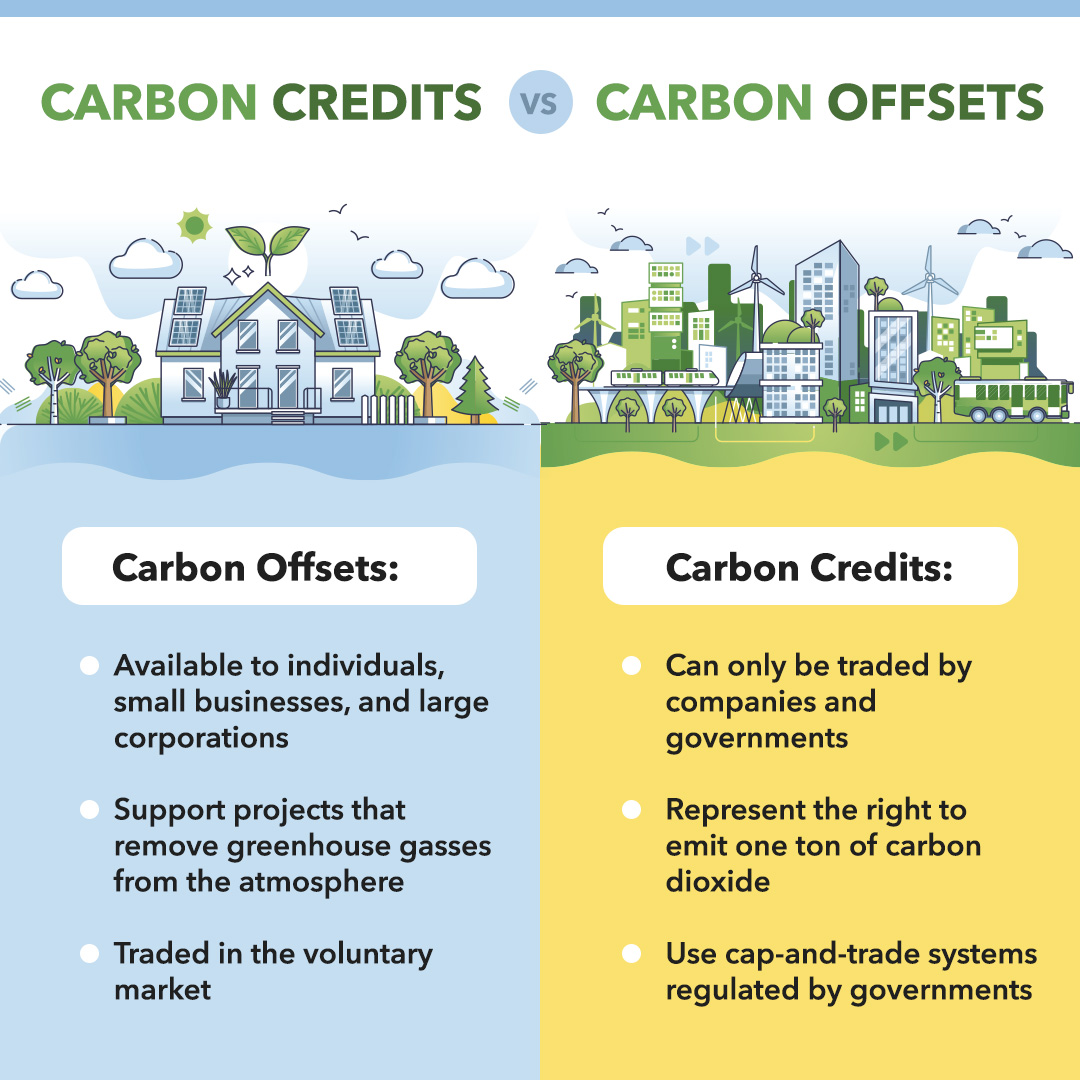

Credible carbon credits are verified and certified units that represent the reduction, avoidance, or removal of one metric ton of carbon dioxide (CO₂) or its equivalent in other greenhouse gases (GHGs). These credits are issued under rigorous standards and are used by organizations or individuals to offset their carbon footprint. To be considered credible, carbon credits must meet specific criteria, including:

- Additionality: The project must demonstrate that the emissions reduction would not have occurred without the carbon credit financing.

- Verification: The project must be independently verified by a third-party auditor to ensure accuracy and transparency.

- Permanence: The emissions reduction or removal must be long-term and not reversible.

- No Double Counting: The credit must not be claimed by more than one entity or used in multiple registries.

How Are Credible Carbon Credits Generated?

Credible carbon credits are generated through projects that reduce, avoid, or remove greenhouse gas emissions. These projects can include:

- Renewable Energy: Wind, solar, or hydroelectric power projects that replace fossil fuel-based energy sources.

- Reforestation and Afforestation: Planting trees or restoring forests to absorb CO₂ from the atmosphere.

- Energy Efficiency: Implementing technologies or practices that reduce energy consumption in industries or buildings.

- Methane Capture: Capturing methane emissions from landfills or agricultural activities to prevent their release into the atmosphere.

What Standards Ensure the Credibility of Carbon Credits?

Several internationally recognized standards ensure the credibility of carbon credits. These include:

- Verified Carbon Standard (VCS): One of the most widely used standards, ensuring rigorous project validation and verification.

- Gold Standard: Focuses on sustainable development alongside emissions reduction, requiring projects to contribute to social and environmental benefits.

- Clean Development Mechanism (CDM): Established under the Kyoto Protocol, it certifies projects in developing countries.

- American Carbon Registry (ACR): Provides a transparent and credible framework for carbon credit issuance in North America.

Why Is Additionality Important for Credible Carbon Credits?

Additionality is a critical factor in determining the credibility of carbon credits. It ensures that the emissions reductions or removals would not have occurred without the financial incentive provided by the carbon credit market. Key aspects include:

- Financial Additionality: The project must rely on carbon credit revenue to be financially viable.

- Regulatory Additionality: The project must go beyond existing legal requirements or industry standards.

- Technological Additionality: The project must use innovative or advanced technologies that are not yet widely adopted.

How Do Third-Party Verifications Enhance Credibility?

Third-party verifications play a crucial role in ensuring the credibility of carbon credits by providing an unbiased assessment of the project's claims. This process involves:

- Independent Audits: Accredited auditors review project documentation, methodologies, and data to ensure compliance with standards.

- Transparency: Verified projects must publicly disclose their methodologies, monitoring plans, and verification reports.

- Accountability: Regular monitoring and reporting ensure that the project continues to meet its stated goals over time.

Is buying carbon credits a good investment?

What Are Carbon Credits?

Carbon credits are tradable certificates that represent the right to emit one ton of carbon dioxide or an equivalent amount of other greenhouse gases. They are part of a cap-and-trade system designed to reduce emissions by setting a limit on pollution and allowing companies to buy or sell allowances as needed.

- Purpose: Carbon credits aim to incentivize companies to reduce their carbon footprint by creating a financial value for emission reductions.

- Market Mechanism: They operate within a regulated market, where companies that reduce emissions below their cap can sell excess credits to others.

- Global Impact: By trading carbon credits, businesses contribute to global efforts to combat climate change.

How Do Carbon Credits Work as an Investment?

Investing in carbon credits involves purchasing these certificates with the expectation that their value will increase over time due to stricter environmental regulations and higher demand for emission reductions.

- Price Volatility: The value of carbon credits can fluctuate based on regulatory changes, market demand, and geopolitical factors.

- Long-Term Growth: As governments worldwide implement stricter climate policies, the demand for carbon credits is expected to rise, potentially increasing their value.

- Diversification: Carbon credits can be a way to diversify an investment portfolio, as they are not directly tied to traditional financial markets.

What Are the Risks of Investing in Carbon Credits?

While carbon credits offer potential benefits, they also come with significant risks that investors should consider.

- Regulatory Changes: Shifts in government policies or international agreements can drastically affect the carbon credit market.

- Market Liquidity: The carbon credit market can be less liquid than other investment markets, making it harder to buy or sell credits quickly.

- Verification Issues: Ensuring the legitimacy and effectiveness of carbon offset projects can be challenging, leading to potential fraud or inefficiency.

What Are the Benefits of Investing in Carbon Credits?

Investing in carbon credits can offer several advantages, particularly for those looking to align their investments with environmental goals.

- Environmental Impact: By investing in carbon credits, you support projects that reduce greenhouse gas emissions, contributing to climate change mitigation.

- Corporate Responsibility: Companies that invest in carbon credits can enhance their reputation by demonstrating a commitment to sustainability.

- Potential Returns: As the demand for carbon credits grows, there is potential for significant financial returns, especially in a tightening regulatory environment.

How to Start Investing in Carbon Credits?

For those interested in investing in carbon credits, there are several steps to consider before entering the market.

- Research: Understand the carbon credit market, including how it operates, key players, and current trends.

- Choose a Platform: Select a reputable platform or broker that specializes in carbon credit trading.

- Diversify: Consider diversifying your investments across different types of carbon credits and projects to mitigate risk.

What are good carbon credits?

What Defines a Good Carbon Credit?

Good carbon credits are those that meet stringent criteria to ensure they effectively reduce or remove greenhouse gas emissions. Key characteristics include:

- Additionality: The project must demonstrate that the emissions reductions would not have occurred without the carbon credit funding.

- Verification: Credits should be verified by independent third parties to ensure accuracy and transparency.

- Permanence: The emissions reductions or removals must be long-term and not easily reversible.

Why Are Verified Carbon Credits Important?

Verified carbon credits are crucial because they provide assurance that the claimed emissions reductions are real and measurable. This is achieved through:

- Third-Party Audits: Independent organizations assess the project's impact and methodologies.

- Transparency: Detailed documentation and reporting are required to track progress and outcomes.

- Accountability: Ensures that buyers are investing in legitimate and impactful projects.

How Do Carbon Credits Support Sustainable Development?

Carbon credits can contribute to sustainable development by:

- Funding Renewable Energy: Projects like wind farms or solar installations reduce reliance on fossil fuels.

- Improving Local Communities: Many projects create jobs, improve air quality, and support education and healthcare.

- Protecting Ecosystems: Reforestation and conservation projects preserve biodiversity and natural habitats.

What Are the Challenges in the Carbon Credit Market?

The carbon credit market faces several challenges, including:

- Double Counting: Ensuring that emissions reductions are not claimed by multiple parties.

- Market Fragmentation: Lack of standardization across different carbon credit programs.

- Greenwashing: Some projects may exaggerate their environmental benefits to attract buyers.

How Can Buyers Ensure They Are Purchasing High-Quality Carbon Credits?

Buyers can take several steps to ensure they are purchasing high-quality carbon credits:

- Research the Project: Look for projects with clear documentation and third-party verification.

- Check Certification Standards: Credits certified by reputable standards like the Verified Carbon Standard (VCS) or Gold Standard are more reliable.

- Evaluate Co-Benefits: Consider projects that offer additional environmental or social benefits beyond carbon reduction.

What is the difference between gold standard and verra?

What is the Gold Standard?

The Gold Standard is a certification program that ensures projects reducing greenhouse gas emissions meet rigorous environmental and sustainable development criteria. It was established by the World Wide Fund for Nature (WWF) and other NGOs to provide a credible and transparent framework for carbon offset projects. Key features include:

- High environmental integrity: Projects must demonstrate real, measurable, and long-term emission reductions.

- Sustainable development goals: Projects must contribute to local communities and align with the UN's Sustainable Development Goals (SDGs).

- Third-party verification: Independent auditors verify project compliance with Gold Standard requirements.

What is Verra?

Verra is a global leader in developing standards for environmental and social markets, including the widely used Verified Carbon Standard (VCS). It provides a framework for certifying carbon offset projects and ensuring their credibility. Key aspects include:

- Verified Carbon Standard (VCS): The primary program for certifying carbon credits, ensuring they are real, additional, and permanent.

- Diverse project types: Verra supports a wide range of projects, including renewable energy, forestry, and agriculture.

- Transparency and accountability: Verra maintains a public registry to track carbon credits and ensure their integrity.

Key Differences in Certification Criteria

The Gold Standard and Verra differ in their certification criteria and focus areas. While both aim to ensure high-quality carbon credits, their approaches vary:

- Gold Standard: Emphasizes sustainable development and co-benefits for local communities, requiring projects to align with SDGs.

- Verra: Focuses on the technical aspects of carbon reduction, ensuring projects meet rigorous scientific and methodological standards.

- Project scope: Gold Standard is more selective, often favoring renewable energy and energy efficiency projects, while Verra supports a broader range of initiatives.

Project Types Supported by Each Standard

Both standards support various types of carbon offset projects, but their preferences and requirements differ:

- Gold Standard: Primarily supports renewable energy, energy efficiency, and community-based projects that deliver clear social and environmental benefits.

- Verra: Supports a wider array of projects, including forestry, agriculture, and industrial gas capture, with a focus on measurable carbon reductions.

- Innovation: Verra is often more open to innovative and emerging project types, while Gold Standard maintains stricter eligibility criteria.

Market Recognition and Credibility

Both the Gold Standard and Verra are highly respected in the carbon market, but their recognition and credibility vary:

- Gold Standard: Known for its stringent requirements and focus on sustainable development, it is often preferred by organizations prioritizing social and environmental co-benefits.

- Verra: Recognized for its robust technical standards and broad applicability, it is widely used by corporations and governments for large-scale carbon offsetting.

- Market share: Verra has a larger market share due to its flexibility and support for diverse project types, while Gold Standard is favored for its high-quality, community-focused projects.

Frequently Asked Questions (FAQ)

What criteria should I consider when choosing trustworthy carbon credits for long-term investment?

When selecting carbon credits for a long-term investment, it's essential to evaluate the credibility of the project. Look for certifications from recognized standards like Verra (VCS), Gold Standard, or Climate Action Reserve. These organizations ensure that the projects meet rigorous environmental and social criteria. Additionally, consider the additionality of the project, meaning it should demonstrate that the carbon reductions wouldn't have occurred without the investment. Transparency in reporting and third-party verification are also critical factors to ensure the project's genuine impact.

How can I verify the authenticity of a carbon credit project?

To verify the authenticity of a carbon credit project, start by checking if it is registered with a reputable carbon standard. These standards provide public registries where you can track the project's progress and verify its claims. Additionally, review the project's monitoring reports and third-party audits to ensure transparency. Look for projects that provide detailed information about their methodologies, emission reductions, and community benefits. Engaging with independent experts or consultants can also help you assess the project's legitimacy and long-term viability.

What types of carbon credit projects are most reliable for long-term investment?

For long-term investment, focus on projects that have a proven track record of delivering sustainable outcomes. Renewable energy projects, such as wind or solar farms, are often reliable because they provide consistent and measurable carbon reductions. Reforestation and afforestation projects are also strong candidates, as they offer co-benefits like biodiversity conservation and community development. Avoid projects with high risks of leakage or reversals, such as those in politically unstable regions or those dependent on uncertain future technologies.

How do I ensure that my investment in carbon credits aligns with my sustainability goals?

To align your investment with your sustainability goals, choose projects that not only reduce carbon emissions but also contribute to broader environmental and social objectives. Look for projects that support UN Sustainable Development Goals (SDGs), such as clean water access, poverty alleviation, or gender equality. Additionally, consider the project's longevity and its ability to adapt to future challenges, such as climate change impacts. By investing in projects that align with your values, you can ensure that your contribution has a meaningful and lasting impact.

Leave a Reply

Our Recommended Articles